Merchant Matrix Features

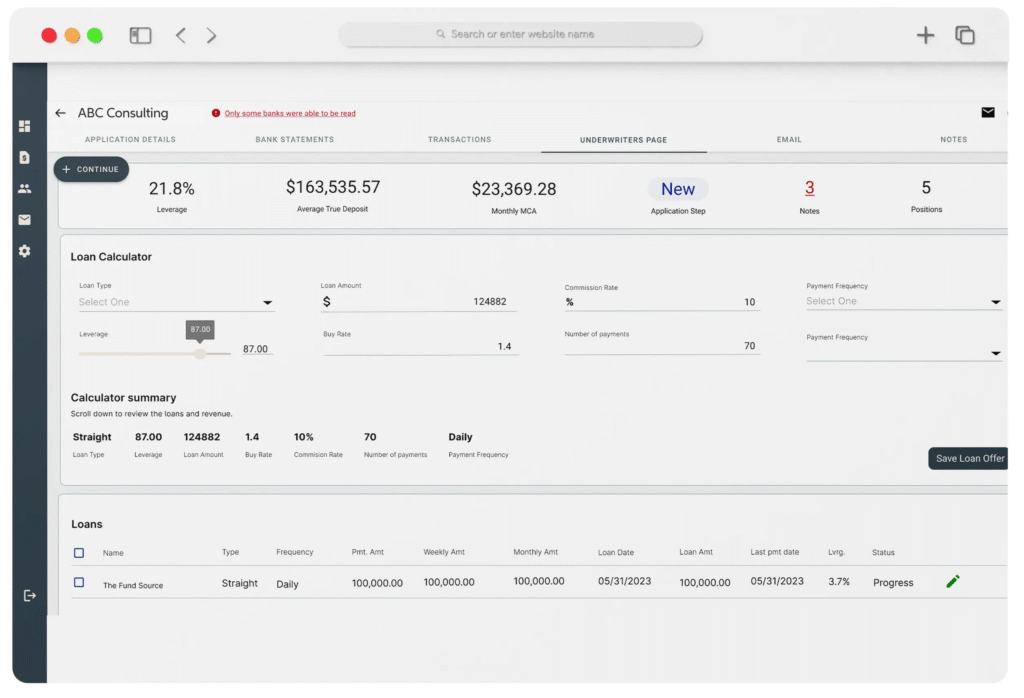

Extracting underwriting statistics

Extracting underwriting statistics

Extracted from the PDFs we provide you with organized, filtered, and searchable data growing our network to read the majority of banks.

This includes the following:

- Previous loan positions (active and completed)

- Revenue breakdown per statement

- True deposits vs non-true deposits

- Leverage detail

- Leverage summaries

- Non-sufficient funds details

- Daily balances

- Negative days

With these statistics in place, you can make faster more efficient underwriting decisions.

At Merchant Matrix, we understand that time is everything in underwriting. That’s why our platform doesn’t just extract data—it interprets it. From bank statements to transactional histories, we identify patterns and performance indicators that traditional tools often miss. This means funders and brokers can make decisions based not only on raw data, but on statistical trends, risk flags, and predictive fundability scores that are tailored to each merchant’s unique profile.

Our intelligent parsing engine reads, classifies, and analyzes unstructured financial documents with bank-grade accuracy. It captures critical statistics such as daily balances, average deposits, NSFs, and ending trends—all within seconds. These statistics are then translated into actionable insights through real-time dashboards and visual summaries, giving underwriters complete clarity without the manual legwork.

But we don’t stop at insights—we deliver trust and efficiency at scale. Whether you’re funding 10 merchants a month or 10,000, Merchant Matrix ensures that every application is vetted with the same level of speed, consistency, and scrutiny. By embedding statistical underwriting into your workflow, we help you reduce friction, mitigate fraud, and say “yes” to the right clients faster than ever before.